How It Works

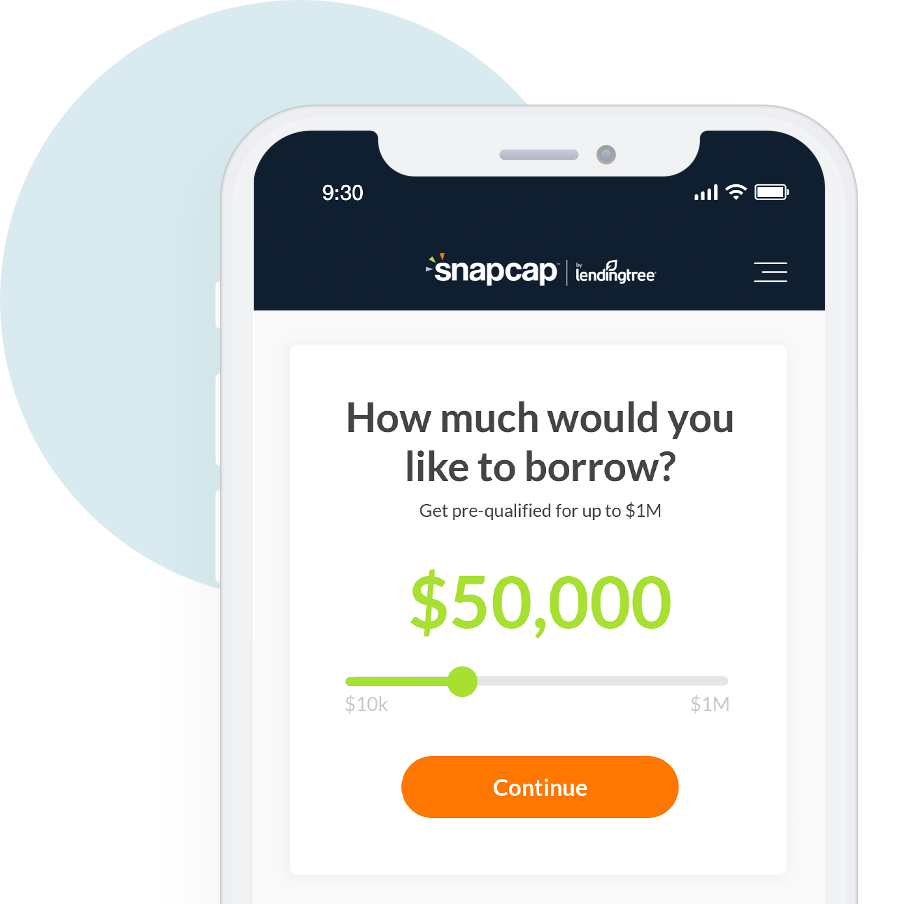

Get pre-qualified for up to $600k

How it works with SnapCap?

When ready to start our Express Review, you will be invited to tell us about yourself and your business. We only ask what we absolutely need to know to qualify your business as quickly as possible. Some questions include:

One of our experienced account managers will contact you for more information. In most cases we can review your request in a just a few hours so you can get back to running your business.

Qualifying for a business loan

Meeting minimum requirements does not guarantee funding, but we’ll work hard to get you the funding that you need.

Why We are Different

Business funding requests can be a confusing and expensive process if you go to the wrong lender. Over the years we have focused on delivering fast decisions at the lowest rates with the least amount of hassle. We empower our team with the best financial technology in alternative lending to exceed your expectations.

We also understand that business owners need more than just a quick decision and a competitive rate. You want a relationship you can depend on, which is where SnapCap stands out from the competition.

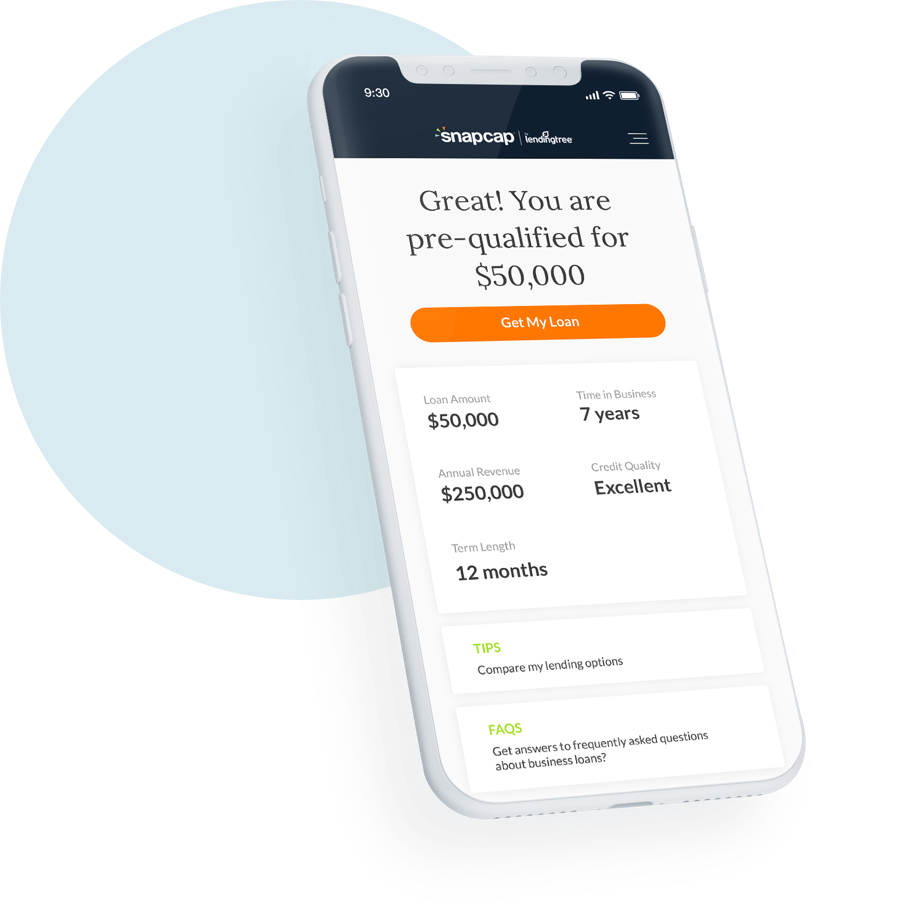

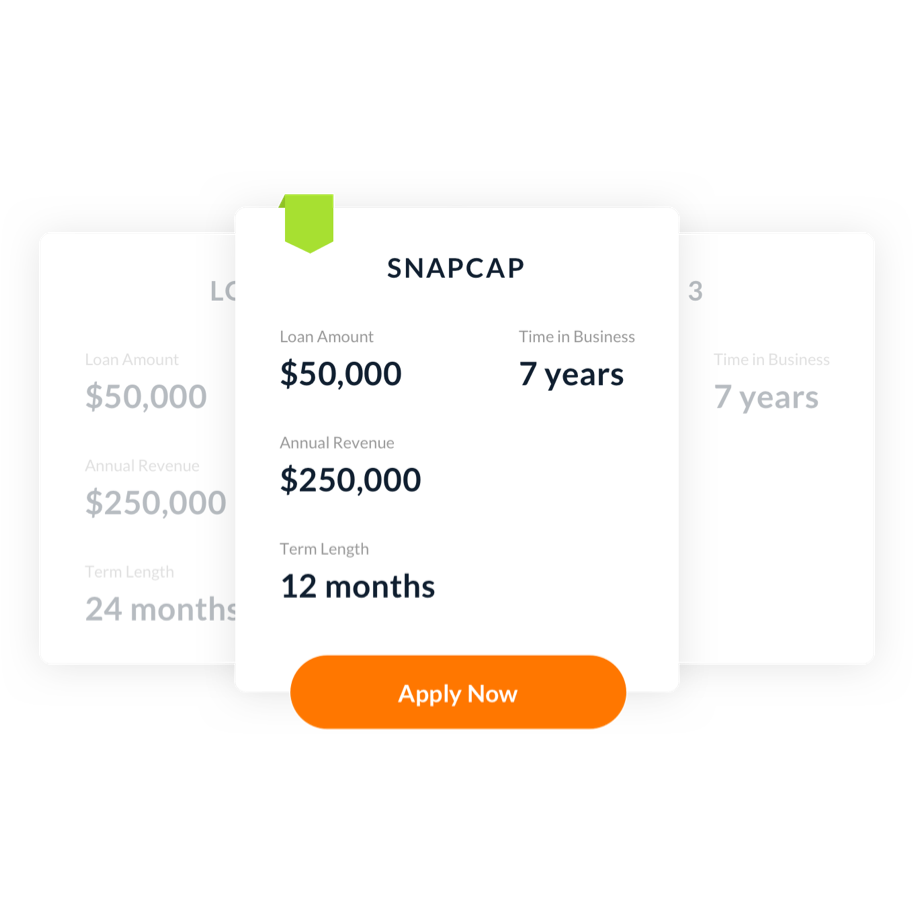

Compare Us

At SnapCap, a simple review of your bank statements and some specifics about your business allows us to accurately pre-qualify approve and provide access to funding for your business. Instead of a rigid 4-8 week review and the back and forth shuffle, SnapCap can offer you access to loan terms in just a few hours. The streamlined process allows you to focus on running your business.

Recent Loan Transactions

We invite you to review a sample of business loans that we have facilitated for real business owners. The amounts and terms listed provide a broad representation of the loans we successfully help fund every day.

We are small business

After 8 years of helping merchants secure over $967M in total funding, we have come to understand that business owners across the country simply needed a better way to fund their business. SnapCap was created to support growing businesses by connecting them with credit when they need it – without the hassle. Our relationship will grow as your business grows. Together we can achieve great things and we hope you will give us the opportunity to earn your business.